UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported):

| Commission

File Number |

Exact Name of Registrant as Specified in Its Charter, Address of Principal

Executive Offices and Telephone |

State of

|

I.R.S. |

|

( |

|||

|

( |

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule

12b-2 of the Securities Exchange Act of 1934. Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 7.01. | Regulation FD Disclosure |

In connection with the offering described in Item 8.01 below, Icahn Enterprises L.P. (“Icahn Enterprises”) is making investor presentations to certain existing and potential investors.

The investor presentation is attached hereto as Exhibit 99.1

The information in this Item 7.01, including the exhibits attached hereto, of this Current Report on Form 8-K shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and shall not be deemed to be incorporated by reference into any of the Registrant’s filings under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, whether made before or after the date hereof and regardless of any general incorporation language in such filings, except to the extent expressly set forth by specific reference in such a filing.

| Item 8.01 | Other Events |

On January 4, 2021, Icahn Enterprises issued a press release announcing that it, together with Icahn Enterprises Finance Corp. (together with Icahn Enterprises, the “Issuers”), intends to commence an offering of Senior Notes due 2029 (the “Notes”), for issuance in a private placement (the “Notes Offering”) not registered under the Securities Act. The Notes will be issued under an indenture to be dated the issue date of the Notes by and among the Issuers, Icahn Enterprises Holdings L.P., as guarantor, and Wilmington Trust, National Association, as trustee. The net proceeds from the Notes Offering will be used to redeem a portion of the Issuers’ existing 6.250% Senior Notes due 2022 pursuant to the Issuers’ previously announced notice of conditional redemption. There can be no assurance that the issuance and sale of any debt securities of the Issuers will be consummated, that the conditions precedent to the redemption will be satisfied, or that the redemption will occur.

A copy of the press release is attached hereto as Exhibit 99.2.

This Current Report on Form 8-K is neither an offer to sell nor a solicitation of an offer to buy any securities of Icahn Enterprises.

| Item 9.01. | Financial Statements and Exhibits |

(d) Exhibits

99.2 – Press Release dated January 4, 2021 announcing the Notes Offering.

104 – Cover Page Interactive Data File (formatted in Inline XBRL in Exhibit 101).

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, each Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

ICAHN ENTERPRISES L.P. (Registrant) | |||

| By: |

Icahn Enterprises G.P. Inc. its general partner | ||

| Date: January 4, 2021 | By: | /s/ Ted Papapostolou | |

| Ted Papapostolou | |||

| Chief Accounting Officer | |||

|

ICAHN ENTERPRISES HOLDINGS L.P. (Registrant) | |||

| By: |

Icahn Enterprises G.P. Inc. its general partner | ||

| Date January 4, 2021 | By: | /s/ Ted Papapostolou | |

|

|

Ted Papapostolou Chief Accounting Officer | ||

Exhibit 99.1

Icahn Enterprises L.P. Investor Presentation January 2021

Forward - Looking Statements and Non - GAAP Financial Measures Forward - Looking Statements This presentation contains certain statements that are, or may be deemed to be, “forward - looking statements” within the meaning of Section 27 A of the Securities Act of 1933 , as amended, and Section 21 E of the Securities Exchange Act of 1934 , as amended . All statements included herein, other than statements that relate solely to historical fact, are “forward - looking statements . ” Such statements include, but are not limited to, any statement that may predict, forecast, indicate or imply future results, performance, achievements or events, or any statement that may relate to strategies, plans or objectives for, or potential results of, future operations, financial results, financial condition, business prospects, growth strategy or liquidity, and are based upon management’s current plans and beliefs or current estimates of future results or trends . Forward - looking statements can generally be identified by phrases such as “believes,” “expects,” “potential,” “continues,” “may,” “should,” “seeks,” “predicts,” “anticipates,” “intends,” “projects,” “estimates,” “plans,” “could,” “designed,” “should be” and other similar expressions that denote expectations of future or conditional events rather than statements of fact . Our expectations, beliefs and projections are expressed in good faith and we believe that there is a reasonable basis for them . However, there can be no assurance that these expectations, beliefs and projections will result or be achieved . There are a number of risks and uncertainties that could cause our actual results to differ materially from the forward - looking statements contained in this presentation , including economic, competitive, legal and other factors, including the severity, magnitude and duration of the COVID - 19 pandemic . These risks and uncertainties are described in our Annual Report on Form 10 - K for the year ended December 31 , 201 9 and our Quarterly Report s on Form 10 - Q for the quarter s ended March 31 , 2020 , June 30 , 2020 and September 30 , 2020 . There may be other factors not presently known to us or which we currently consider to be immaterial that may cause our actual results to differ materially from the forward - looking statements . All forward - looking statements attributable to us or persons acting on our behalf apply only as of the date of this presentation and are expressly qualified in their entirety by the cautionary statements included in this presentation . Except to the extent required by law, we undertake no obligation to update or revise forward - looking statements to reflect events or circumstances after the date such statements are made or to reflect the occurrence of unanticipated events . Non - GAAP Financial Measures This presentation contains certain non - GAAP financial measures, including EBITDA, Adjusted EBITDA and Indicative Net Asset Value . The non - GAAP financial measures contained herein have limitations as analytical tools and should not be considered in isolation or in lieu of an analysis of our results as reported under U . S . GAAP . These non - GAAP measures should be evaluated only on a supplementary basis in connection with our U . S . GAAP results, including those reported in our consolidated financial statements and the related notes thereto contained in our Annual Report on Form 10 - K for the year ended December 31 , 201 9 and our Quarterly Report s on Form 10 - Q for the quarter s ended March 31 , 2020 , June 30 , 2020 and September 30 , 20 20 . A reconciliation of these non - GAAP financial measures to the most directly comparable U . S . GAAP financial measures can be found in the back of this presentation . 2

Keith Cozza – President & Chief Executive Officer SungHwan Cho – Chief Financial Officer Presenters 3

Agenda 4 • Transaction Overview • Company Overview • Investment Highlights • Financial Performance • Appendix

Transaction Overview 5

Executive Summary 6 • Icahn Enterprises L.P. (“IEP” or the “Company”) is a diversified Holding Company, with global businesses in Investment, Automotive, Energy, Real Estate, Food Packaging, Metals, and Home Fashion ‒ Total equity market capitalization of approximately $12.4 billion (1) as of December 31, 2020 • The net proceeds of this offering of the Notes will be used for the redemption of the existing 6.250% Senior Unsecured Notes due 2022 (2) (1) Based on closing stock price of $50.67 and approximately 245.3 million depositary units owned by affiliates of Carl Icahn as of December 31, 2020. (2) As previously disclosed, the trustee delivered a notice of conditional redemption to holders of the 6.250% senior unsecured n ote s due 2022 on the Company’s behalf on December 31, 2020. The redemption is subject to the satisfaction of the Conditions Precedent (as defined herein). If the Conditions Precedent are sa tis fied, we intend to redeem a portion of the 6.250% senior unsecured notes due 2022 on or about February 1, 2021 (subject to delay in the Company’s discretion until such time as the Conditions P rec edent are satisfied), at a redemption price equal to 100.000% of the principal amount of the notes redeemed, plus accrued and unpaid interest and special interest, if any, thereon to, but no t i ncluding, the redemption date. Sources and Uses of Funds Sources of Funds Uses of Funds ($ millions) New Senior Unsecured Notes due 2029 500$ Redemption of the existing 6.250% Senior Unsecured Notes due 2022 (2) 500$ Cash on Balance Sheet 2 Estimated Fees & Expenses 2 Total Sources 502$ Total Uses 502$

Capitalization and Credit Statistics 7 (1) Gives effect to (i) the issuance of the Notes offered hereby and the use of the net proceeds therefrom, (ii) Viskase’s $100 million equity private placement and debt refinancing completed in October 2020 and (iii) the sale of the maximum aggregate offering amount of $400 million in sales proceeds pursuant to the open market sales program. Sa les made under the open market sales program, if any, will be made from time to time during the term of the program ending on March 31, 2021, at such prices and times as Icahn Enterprises may agree with the age nt. Sales under the open market sales program are made by the agent on a commercially reasonable efforts basis and no assurance can be made that any or all amounts of depositary units will be sold b y I cahn Enterprises. As previously disclosed, the trustee delivered a notice of conditional redemption to holders of our 6.250% senior unsecured notes due 2022 on our behalf on December 31, 2020. The redemption is sub jec t to the satisfaction of the Conditions Precedent. If the Conditions Precedent are satisfied, we intend to redeem a portion of the 6.250% senior unsecured notes due 2022 on or about February 1, 2021 (subject to delay in our discretion until such time as the Conditions Precedent are satisfied) at a redemption price equal to 100.000% of the principal amount of the notes redeemed, plus accrued and unpaid interest and specia l i nterest, if any, thereon to, but not including, the redemption date. (2) Debt is non - recourse to Icahn Enterprises. (3) Based on closing stock price of $50.67 and approximately 221.7 million depositary units owned by affiliates of Carl Icahn as of December 31, 2020. (4) Based on closing stock price of $49.32 and approximately 236.8 million depositary and general partner equivalent units outsta ndi ng as of September 30, 2020. (5) Indicative gross asset value defined as market value of public subsidiaries, market value of the Holding Company interest in the Investment Funds and book value or market comparables of other assets. Key Points • Strong pro forma financial metrics (1) : ‒ Total consolidated liquidity of $6.7 billion ‒ Indicative gross asset value to Holding Company net debt coverage of 1.7x • Holding Company cash and cash equivalents value of $1.3 billion (1) • Affiliates of Carl Icahn own 92.2% of IEP’s outstanding depositary units valued at $11.2 billion (3) as of December 31, 2020 ($Millions) Actual As Adjusted (1) Liquid Assets: Holding Company Cash & Cash Equivalents $1,087 $1,257 Holding Company Investment in Funds 4,043 4,043 Holding Company Liquid Assets $5,130 $5,300 Subsidiaries Cash & Cash Equivalents 775 775 Total Liquid Assets $5,905 $6,075 Holding Company Debt: 6.250% Senior Unsecured Notes due 2022 1,209 709 6.750% Senior Unsecured Notes due 2024 499 499 4.750% Senior Unsecured Notes due 2024 1,107 1,107 6.375% Senior Unsecured Notes due 2025 748 748 6.250% Senior Unsecured Notes due 2026 1,250 1,250 5.250% Senior Unsecured Notes due 2027 999 999 New Senior Unsecured Notes due 2029 - 500 Holding Company Debt $5,812 $5,812 Subsidiary Debt (2) 2,334 2,234 Total Consolidated Debt (a) $8,146 $8,046 Minority Interest (b) $5,643 $5,643 Shareholders' Book Equity (c) 3,230 3,518 Total Book Capitalization (a) + (b) + (c) $17,019 $17,207 Stockholders' Market Equity (4) (d) 11,679 11,967 Total Capitalization (a) + (b) + (d) $25,468 $25,656 Supplemental Information: Indicative Gross Asset Value (excluding Holding Company Cash) (5) $7,944 $7,944 Indicative Gross Asset Value / Holding Company Net Debt 1.7x 1.7x Holding Company Liquid Assets / Holding Company Debt 0.9x 0.9x As of September 30, 2020

Summary of Terms 8 Issuers Icahn Enterprises L.P. (“IEP” or the “Company”) and Icahn Enterprises Finance Corp. Issue $500.0 million of Senior Unsecured Notes (the “Notes”) Term 8 years Optional Redemption Non - callable for life until six months prior to maturity at par Placement Type 144A and Regulation S Private Placement with Registration Rights Use of Proceeds The net proceeds of this offering of the Notes will be used for the redemption of the existing 6.250% Senior Unsecured Notes due 2022 (1) Guarantees The Notes will be unconditionally guaranteed on a senior unsecured basis by Icahn Enterprises Holdings L . P . Ranking The Notes will rank senior in right of payment to all existing and future subordinated indebtedness and equal in right of payment with all other existing and future senior unsecured indebtedness . The Notes will be effectively subordinated to all indebtedness and liabilities, including trade payables, of all subsidiaries other than Icahn Enterprises Holdings L . P . The Notes will be effectively subordinated to all of our and Icahn Enterprises Holdings L . P . ’s existing and future secured indebtedness to the extent of the collateral securing such indebtedness Mandatory Redemption None Change of Control Offer 101% of aggregate principal amount of Notes repurchased plus accrued and unpaid interest Covenants Maintenance and Debt Incurrence covenants same as existing notes Restricted Payments Same as existing 5.250% senior unsecured notes due 2027 Sole Bookrunner Jefferies LLC (1) As previously disclosed, the trustee delivered a notice of conditional redemption to holders of the 6.250% senior unsecured n ote s due 2022 on the Company’s behalf on December 31, 2020. The redemption is subject to the satisfaction of the Conditions Precedent (as defined herein). If the Conditions Precedent are sa tis fied, we intend to redeem a portion of the 6.250% senior unsecured notes due 2022 on or about February 1, 2021 (subject to delay in the Company’s discretion until such time as the Conditions P rec edent are satisfied), at a redemption price equal to 100.000% of the principal amount of the notes redeemed, plus accrued and unpaid interest and special interest, if any, thereon to, but no t i ncluding, the redemption date.

Company Overview 9

Overview of Icahn Enterprises • Icahn Enterprises L.P. is a diversified H olding C ompany with operating segments in Investment, Energy, Automotive, Food Packaging, Metals, Real Estate and Home Fashion • IEP is majority owned and controlled by Carl Icahn ‒ Over many years, Carl Icahn has contributed most of his businesses to and executed transactions primarily through IEP ‒ As of September 30, 2020 , Icahn Enterprises had interests in the Investment Funds of approximately $4.1 billion • IEP has daily liquidity through its ability to redeem its investment in the funds on a daily basis (1) Excludes Discontinued Operations. (2) Investment segment total assets represents total equity (equity attributable to IEP was $4 .1 billion) . 10 Investment (2) $8,839 ($1,719) ($980) ($892) Energy 4,637 4,367 (115) 87 Automotive 3,160 2,579 (218) (73) Food Packaging 506 390 (1) 43 Metals 241 275 (19) 4 Real Estate 490 100 3 26 Home Fashion 235 195 (6) 4 Holding Company 1,588 (195) (612) (246) $19,696 $5,992 ($1,948) ($1,047) ($Millions) Twelve Months Ended September 30, 2020 (1) As of September 30, 2020 Assets Revenue Net Income (Loss) Atttributable to IEP Adjusted EBITDA Attributable to IEP

CVR Energy Inc. (NYSE: CVI) Summary Corporate Organizational Chart WestPoint Home LLC (“WPH”) PSC Metals LLC AREP Real Estate Holdings, LLC Icahn Enterprises G.P. Inc. Icahn Enterprises L.P. (NasdaqGS: IEP) Icahn Enterprises Holdings L.P. Icahn Capital LP Viskase Companies Inc. (OTCPK:VKSC) As of 9/30/2020, Icahn Enterprises had interests in the Investment Funds of approximately $4.1 billion One of the largest independent metal recycling companies in the US Consists of rental commercial real estate, property development and associated resort activities Provider of home textile products for nearly 200 years One of the worldwide leaders in cellulosic, fibrous and plastic casings for processed meat industry Independent refiner and marketer of transportation fuels Producer and distributer of nitrogen fertilizer products CVR Partners, LP (NYSE: UAN) Note: Percentages denote equity ownership as of October 31, 2020 . Excludes intermediary and pass - through entities. 11 Icahn Automotive Group LLC Engaged in the distribution of automotive parts in the aftermarket as well as providing automotive services 99% LP Interest 1% 1% 8 9% 71% 100% 100% 100% 100% 100% 3 5 %

Investment Highlights 12

• Diversified Holdings • History of Successfully Monetizing Investments • Diversification Across Industries and Geographies Proves a Natural Hedge Against Cyclical and General Economic Swings • Significant Asset Coverage • Liquidity Serves as a Competitive Advantage • Deep Management Team Led by Carl Icahn Investment Highlights 13 1 2 3 4 5 6

Diversified Holdings 14 1 • The Company is well diversified across various industries and sectors Asset Mix by Operating Segments for Icahn Enterprises (1)(2) Note: As of September 30, 2020. Market valued subsidiaries based on closing share price and the number of shares owned by the Ho lding Company as of September 30, 2020. (1) Indicative gross asset value defined as market value of public subsidiaries, market value of the Holding Company investment i n F unds and book value or market comparables of other assets. (2) Excludes other Holding Company net assets. In December 2020, the Company acquired all of the outstanding common stock of Vivus , Inc. (“ Vivus ”) upon its emergence from bankruptcy. Prior to Vivus ’ emergence from bankruptcy, the Company held an investment in all of Vivus ’ convertible corporate debt securities and 1 st lien debt securities. (3) Investment segment total assets represents total equity (equity attributable to IEP was $4.1 billion). (4) Automotive includes Tenneco, Icahn Automotive Group and 767 Auto Leasing. (5) Energy includes CVR Energy. (6) Includes Viskase. Valued at 9.0x Adjusted EBITDA for the twelve months ended September 30, 2020 and is pro forma for Viskase’ s $ 100 million equity private placement and debt refinancing completed in October 2020. (7) Metals includes PSC Metals, Inc. (8) Home fashion includes WestPoint Home. 52% 24% 11% 6% 3% 2% 2% Investment Automotive Energy Real Estate Food Packaging Metals Home Fashion (6) (3) (4) (5) (7) (8)

History of Successfully Monetizing Investments 15 2 • Sold American Railcar Leasing, LLC (“ARL”) during 2017 for $3.4 billion including assumption of debt, resulting in cash proceeds to IEP of $1.8 billion. IEP acquired ARL in 2013 for total consideration of approximately $772 million • August 2017 sale of Las Vegas property for $600 million. IEP originally acquired the Fontainebleau for $148 million in February 2010 • October 2018 sale of Federal Mogul for $800 million cash consideration and 29.5 million shares of Tenneco (NYSE: TEN) common stock (currently valued at $10.60 per share as of 12/31/20) ‒ Sold 1.85 million shares of TEN and received $19.9 million proceeds in Q4 2020 • October 2018 sale of Tropicana Entertainment for aggregate consideration of approximately $1.8 billion. IEP portion of cash consideration received was approximately $1.5 billion • December 2018 sale of American Railcar Industries, Inc. (‘‘ARI’’) for $1.75 billion, including assumption of debt, resulting in cash proceeds to IEP of $831 million • August 2019 sale of Ferrous Resources for $550 million valuation, including repaid indebtedness. IEP share of cash proceeds was $463 million, net of adjustments Note: As of September 30, 2020.

Historical Segment Financial Summary ($Millions) Selected Income Statement Data: Total revenue $297 $737 ($1,414) ($1,719) Adjusted EBITDA 284 725 (1,437) (1,731) Net income (loss) 118 679 (1,543) (1,916) Adjusted EBITDA attributable to IEP $138 $339 ($723) ($892) Net income (loss) attributable to IEP 80 319 (775) (980) Returns 2.1% 7.9% -15.4% -15.6% Segment Balance Sheet Data (1) : Equity attributable to IEP $3,052 $5,066 $4,296 $4,058 Total Equity 7,417 10,101 8,783 8,839 Investment Segment FYE December 31, LTM September 30, 20202017 2018 2019 Highlights and Recent Developments • Since inception in 2004 through September 30, 2020, the Investment Funds’ cumulative return was approximately 63.6 %, representing an annualized rate of return of approximately 3.1 % • Long history of investing in public equity and debt securities and pursuing activist agenda • Employs an activist strategy that seeks to unlock hidden value through various tactics ‒ Financial / balance sheet restructurings (e.g., CIT Group, Apple) ‒ Operational turnarounds (e.g., Motorola, Navistar) ‒ Strategic initiatives (e.g., eBay / PayPal, Xerox / Conduent) ‒ Corporate governance changes (e.g., Newell, Caesars, DELL Technologies) • As of September 30, 2020 , the Investment Funds had a net long notional exposure of approximately 8 % Segment: Investment Segment Description • IEP invests its proprietary capital through various private investment funds (the “Investment Funds”) managed by the Investment segment • Fair value of IEP’s interest in the Investment Funds was approximately $4. 1 billion as of September 30 , 20 20 • IEP has daily liquidity through its ability to redeem its investment in the Investment Funds on a daily basis 16 S ignificant Holdings As of September 30, 2020 Company Mkt. Value ($mm) % Ownership ( 2 ) $ 956 15.5 % $ 931 8.0 % $ 887 9.5 % $ 750 10.3 % $ 728 16.8 % 3 (1) Balance Sheet data as of the end of each respective fiscal period. (2) Total economic ownership as a percentage of common shares issued and outstanding.

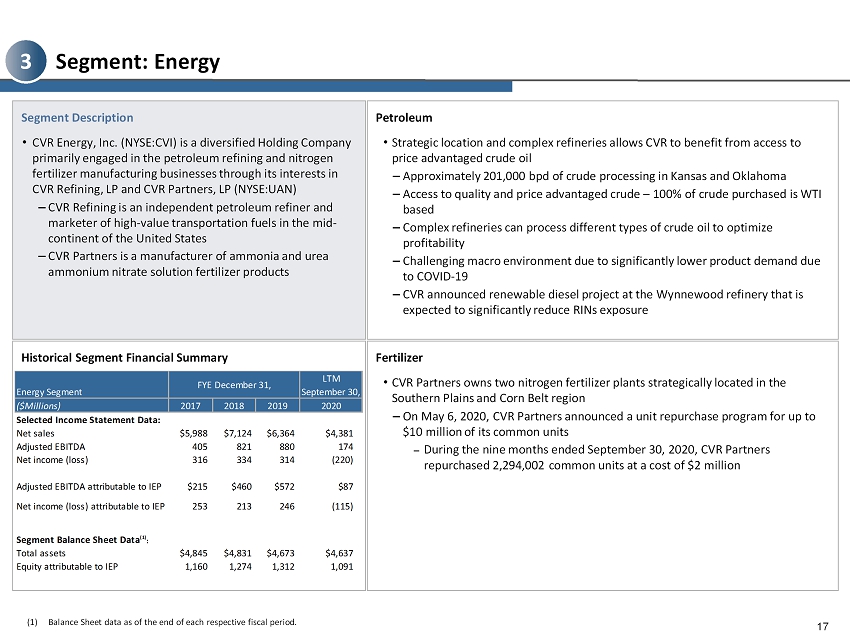

Segment: Energy Segment Description • CVR Energy, Inc. (NYSE:CVI) is a diversified Holding Company primarily engaged in the petroleum refining and nitrogen fertilizer manufacturing businesses through its interests in CVR Refining, LP and CVR Partners, LP (NYSE:UAN) ‒ CVR Refining is an independent petroleum refiner and marketer of high - value transportation fuels in the mid - continent of the United States ‒ CVR Partners is a manufacturer of ammonia and urea ammonium nitrate solution fertilizer products Historical Segment Financial Summary 17 (1) Balance Sheet data as of the end of each respective fiscal period. Petroleum • Strategic location and complex refineries allows CVR to benefit from access to price advantaged crude oil ‒ Approximately 2 01 ,000 bpd of crude processing in Kansas and Oklahoma ‒ Access to quality and price advantaged crude – 100% of crude purchased is WTI based ‒ Complex refineries can process different types of crude oil to optimize profitability ‒ Challenging macro environment due to significantly lower product demand due to COVID - 19 ‒ CVR announced renewable diesel project at the Wynnewood refinery that is expected to significantly reduce RINs exposure Fertilizer • CVR Partners owns two nitrogen fertilizer plants strategically located in the Southern Plains and Corn Belt region ‒ On May 6, 2020, CVR Partners announced a unit repurchase program for up to $10 million of its common units ‒ During the nine months ended September 30, 2020, CVR Partners repurchased 2,294,002 common units at a cost of $2 million ($Millions) Selected Income Statement Data: Net sales $5,988 $7,124 $6,364 $4,381 Adjusted EBITDA 405 821 880 174 Net income (loss) 316 334 314 (220) Adjusted EBITDA attributable to IEP $215 $460 $572 $87 Net income (loss) attributable to IEP 253 213 246 (115) Segment Balance Sheet Data (1) : Total assets $4,845 $4,831 $4,673 $4,637 Equity attributable to IEP 1,160 1,274 1,312 1,091 Energy Segment FYE December 31, LTM September 30, 20202017 2018 2019 3

Segment: Automotive Segment Description • We conduct our Automotive segment through our wholly owned subsidiary Icahn Automotive Group LLC ("Icahn Automotive") • Icahn Automotive is engaged in the retail and wholesale distribution of automotive parts in the aftermarket as well as providing automotive repair and maintenance services to its customers • Our Automotive segment also includes our investment in 767 Auto Leasing LLC, a joint venture created by us to purchase vehicles for lease Historical Segment Financial Summary 18 (1) Balance Sheet data as of the end of each respective fiscal period . Highlights and Recent Developments • Icahn Automotive is in the process of implementing a multi - year transformation plan, which includes the integration and restructuring of its businesses. The transformation plan includes operating the automotive services and aftermarket parts businesses as separate businesses, streamlining Icahn Automotive's corporate and field support teams, facility closures, consolidations and conversions, inventory optimization actions, and the re - focusing of its automotive parts business on certain core markets • Our Automotive segment's priorities include: ‒ Positioning the service business to take advantage of opportunities in the do - it - for - me market and vehicle fleets; ‒ Optimizing the value of the commercial parts distribution business in certain high - volume core markets; ‒ Exiting the automotive parts distribution business in certain low volume, non - core markets; ‒ Improving inventory management across Icahn Automotive's parts and tire distribution network; ‒ Investment in customer experience initiatives such as enhanced customer loyalty programs and selective upgrades in facilities; ‒ Investment in employees with focus on training and career development investments; and ‒ Business process improvements, including investments in our supply chain and information technology capabilities • COVID - 19 pandemic has led to an acceleration of selective planned store closures (2 ) ($Millions) Selected Income Statement Data: Net sales and other revenue from operations $2,723 $2,858 $2,884 $2,585 Adjusted EBITDA 3 (48) (80) (73) Net income (loss) (51) (230) (197) (218) Adjusted EBITDA attributable to IEP $3 ($48) ($80) ($73) Net income (loss) attributable to IEP (51) (230) (197) (218) Segment Balance Sheet Data (1) : Total assets $3,011 $3,024 $3,495 $3,160 Equity attributable to IEP 1,727 1,747 1,750 1,654 Automotive Segment FYE December 31, LTM September 30, 20202017 2018 2019 3

Highlights and Recent Developments • Future growth expected to be driven by changing diets of a growing middle class in emerging markets ‒ Majority of revenues from emerging markets • Developed markets remain a steady source of income ‒ Distribution channels to certain customers spanning more than 50 years • Significant barriers to entry ‒ Technically difficult chemical production process ‒ Significant environmental and food safety regulatory requirements ‒ Substantial capital cost • In October 2020, Viskase completed an equity private placement with IEP for $100 million. In connection with this transaction, our ownership of Viskase increased to approximately 89.0% • In October 2020, Viskase entered into a credit agreement providing for a $150 million term loan and a $30 million revolving credit facility. The proceeds from the new term loan, plus cash received from the equity private placement, were used to repay in full its existing term loan Segment: Food Packaging Segment Description • Viskase Companies, Inc (OTCPK:VKSC) is a worldwide leader in the production and sale of cellulosic, fibrous and plastic casings for the processed meat and poultry industry ‒ Leading worldwide manufacturer of non - edible cellulosic casings for small - diameter meats (hot dogs and sausages) ‒ Leading manufacturer of non - edible fibrous casings for large - diameter meats (sausages, salami, hams and deli meats) Historical Segment Financial Summary 19 (1) Balance Sheet data as of the end of each respective fiscal period. ($Millions) Selected Income Statement Data: Net sales $392 $395 $383 $399 Adjusted EBITDA 62 54 47 53 Net income (loss) (6) (15) (22) (3) Adjusted EBITDA attributable to IEP $45 $43 $37 $43 Net income (loss) attributable to IEP (5) (12) (17) (1) Segment Balance Sheet Data (1) : Total assets $487 $511 $517 $506 Equity attributable to IEP 28 55 40 44 Food Packaging Segment FYE December 31, LTM September 30, 20202017 2018 2019 3

Highlights and Recent Developments • Increasing global demand for steel and other metals drives demand for U.S. scrap • Scrap recycling process is “greener” than virgin steel production ‒ Electric arc furnace s drive scrap demand and are significantly more energy efficient than blast furnaces ‒ Electric arc furnace steel mills are approximately 60% of U.S. production • Highly fragmented industry with potential for further consolidation ‒ Capitalizing on consolidation and vertical integration opportunities ‒ PSC is building a leading position in its markets • Product diversification will reduce volatility through cycles ‒ Expansion of non - ferrous share of total business ‒ Investments in processing plants to increase metal recoveries Segment: Metals Segment Description • PSC Metals LLC is one of the largest independent metal recycling companies in the U.S. • Collects industrial and obsolete scrap metal, processes it into reusable forms and supplies the recycled metals to its customers • Strong regional footprint (Upper Midwest, St. Louis Region and the South) Historical Segment Financial Summary 20 (1) Balance Sheet data as of the end of each respective fiscal period. ($Millions) Selected Income Statement Data: Net sales $409 $466 $340 $273 Adjusted EBITDA 20 24 2 4 Net income (loss) (44) 5 (22) (19) Adjusted EBITDA attributable to IEP $20 $24 $2 $4 Net income (loss) attributable to IEP (44) 5 (22) (19) Segment Balance Sheet Data (1) : Total assets $226 $233 $233 $241 Equity attributable to IEP 182 177 156 144 Metals Segment FYE December 31, LTM September 30, 20202017 2018 2019 3

Highlights and Recent Developments • Business strategy is based on long - term investment outlook and operational expertise Rental Real Estate Operations • Maximize value of commercial lease portfolio through effective management of existing properties ‒ Seek to sell assets on opportunistic basis Property Development & Club Operations • New Seabury in Cape Cod, Massachusetts and Grand Harbor in Vero Beach, Florida include land for future residential development of approximately 147 and 1,09 8 units, respectively • Club operations in New Seabury and Cape Cod and focus on operating golf club and related activities • Includes hotel, timeshare and casino resort property in Aruba and Plaza Hotel and Casino in Atlantic City, NJ, which ceased operations in 2014 Segment: Real Estate Segment Description • Consists of rental real estate, property development and club operations • Rental real estate consists primarily of retail, office and industrial properties leased to single corporate tenants • Property development is focused on the construction and sale of single and multi - family houses, lots in subdivisions and planned communities and raw land for residential development • Club operations focus on operating golf club and related activities Historical Segment Financial Summary 21 (1) Balance Sheet data as of the end of each respective fiscal period. (2) Excludes results from timeshare and casino resort property in Aruba . (2) (2) ($Millions) Selected Income Statement Data: Net sales and other revenue from operations $87 $106 $98 $90 Adjusted EBITDA 40 48 24 26 Net income (loss) 549 112 16 3 Adjusted EBITDA attributable to IEP $40 $48 $24 $26 Net income (loss) attributable to IEP 549 112 16 3 Segment Balance Sheet Data (1) : Total assets $931 $508 $514 $490 Equity attributable to IEP 846 465 474 433 Real Estate Segment FYE December 31, LTM September 30, 20202017 (2) 2018 2019 3

Highlights and Recent Developments • One of the largest providers of home textile goods in the United States • Transitioned majority of manufacturing to low - cost plants overseas • Streamlined merchandising, sales and customer service divisions • Focus on core profitable customers and product lines ‒ WPH has implemented a more customer - focused organizational structure with the intent of expanding key customer relationships and rebuilding the company’s sales backlog ‒ Realizing success placing new brands with top retailers ‒ Continued strength with institutional customers • Consolidation opportunity in fragmented industry • Acquired Vision Support Services ("VSS") in June 2019. VSS produces bedding and bath products for hospitality and healthcare sectors with strong presence in Europe and Middle East. VSS sources from a global network of 50 manufacturers • Seeing high level of demand for face masks which WestPoint started producing in response to COVID - 19 Segment: Home Fashion Segment Description • WestPoint Home LLC is engaged in manufacturing, sourcing, marketing, distributing and selling home fashion consumer products • WestPoint Home owns many of the most well - known brands in home textiles including Martex, Grand Patrician, Luxor and Vellux Historical Segment Financial Summary 22 (1) Balance Sheet data as of the end of each respective fiscal period. ($Millions) Selected Income Statement Data: Net sales $183 $171 $187 $193 Adjusted EBITDA (9) - (6) 4 Net income (loss) (20) (11) (17) (6) Adjusted EBITDA attributable to IEP ($9) $0 ($6) $4 Net income (loss) attributable to IEP (20) (11) (17) (6) Segment Balance Sheet Data (1) : Total assets $183 $172 $231 $235 Equity attributable to IEP 144 133 147 145 2020 FYE December 31, LTM September 30,Home Fashion Segment 2017 2018 2019 3

Significant Asset Coverage 23 • Significant Valuation demonstrated by market value of IEP’s public subsidiaries and Holding Company interest in Funds and boo k value or market comparable of other assets Note: Indicative net asset value does not purport to reflect a valuation of Icahn Enterprises. The calculated indicative net ass et value includes the book value for our Investment Segment, which includes the fair market value of our investment in the Investment Funds. A valuation is a subjective exercise and Indicative net asset value d oes not necessarily consider all elements or consider in the adequate proportion the elements that could affect the valuation of Icahn Enterprises. Investors may reasonably differ on what such elements are and the ir impact on Icahn Enterprises. No representation or assurance, express or implied is made as to the accuracy and correctness of indicative net asset value as of these dates or with respect to any future indicat ive or prospective results which may vary. These preliminary estimates are not a comprehensive statement of our financial results for the year ended December 31, 2020. These preliminary estimated financial res ults have been prepared by, and are the responsibility of our management. Our independent registered public accounting firm has not audited, reviewed or compiled, examined or performed any procedures wit h r espect to the estimated results, nor have they expressed any opinion or any other form of assurance on the preliminary estimated financial results. Our actual results may differ materially from these e sti mates due to the completion of our accounting closing procedures, final adjustments and other developments that may arise between now and the time the financial results for the year ended December 31, 2020 are fi nalized. (1) Represents equity attributable to us as of each respective date, except December 31, 2020, which represents the estimated equ ity attributable to us as of December 31, 2020. (2) Based on closing share price on each date (or if such date was not a trading day, the immediately preceding trading day) and the number of shares owned by the Holding Company as of each respective date. (3) Amounts based on market comparables due to lack of material trading volume, valued at 9.0x Adjusted EBITDA for the twelve mon ths ended September 30, 2020. Pro forma for Viskase’s $100 million equity private placement and debt refinancing completed in October 2020. December 31, 2020 represents the September 30, 2020 pro for ma value. (4) Holding Company’s balance as of September 30, 2020. December 31, 2020 represents the September 30, 2020 value. (5) For September 30, 2020, Holding Company cash and cash equivalents is pro forma for Viskase’s $100 million equity private plac eme nt completed in October 2020. December 31, 2020 represents the September 30, 2020 pro forma value adjusted to reflect proceeds from the sale of certain shares of Tenneco, proceeds from the sa le of depositary units sold in connection with our open market sales program through December 31, 2020 and the interest to be paid in connection with the partial redemption of the 6.250% senior unsecure d n otes due 2020, payable on February 1, 2021. 4 Historical As of Estimated As of ($Millions) 9/30/2020 12/31/2020 Market-valued Subsidiaries and Investments: Holding Company interest in Investment Funds (1) $4,058 $4,282 CVR Energy (2) 881 1,061 Tenneco (2) 204 292 Total market-valued Subsidiaries and Investments $5,143 $5,635 Other Subsidiaries: Viskase (3) $240 $240 Real Estate Holdings (1) 433 433 PSC Metals (1) 144 144 WestPoint Home (1) 145 145 Ferrous Resources - - Icahn Automotive Group (1) 1,654 1,654 Total other subsidiaries $2,616 $2,616 Add: Other Holding Company net assets (4) 185 185 Indicative Gross Asset Value $7,944 $8,436 Add: Holding Company cash and cash equivalents (5) 987 1,033 Less: Holding Company debt (5) (5,812) (5,812) Indicative Net Asset Value $3,119 $3,657

Liquidity Serves as a Competitive Advantage • Our operating subsidiaries and the Holding Company maintain ample liquidity to take advantage of attractive opportunities for their respective businesses 24 5 Create table as of 9/30 (1) Gives effect to (i) the issuance of the Notes offered hereby and the use of the net proceeds therefrom, (ii) Viskase’s $100 million equity private placement and debt refinancing completed in October 2020 and (iii) the sale of the maximum aggregate offering amount of $400 million in sales proceeds pursuant to the op en market sales program. Sales made under the open market sales program, if any, will be made from time to time during the term of the program ending on March 31, 2021, at such prices and t ime s as Icahn Enterprises may agree with the agent. Sales under the open market sales program are made by the agent on a commercially reasonable efforts basis and no assurance can be made that any or all amounts of depositary units will be sold by Icahn Enterprises. As previously disclosed, the trustee delivered a notice of conditional redemption to holders of our 6.250% senio r u nsecured notes due 2022 on our behalf on December 31, 2020. The redemption is subject to the satisfaction of the Conditions Precedent. If the Conditions Precedent are satisfied, we intend t o r edeem a portion of the 6.250% senior unsecured notes due 2022 on or about February 1, 2021 (subject to delay in our discretion until such time as the Conditions Precedent are satisfied) at a re dem ption price equal to 100.000% of the principal amount of the notes redeemed, plus accrued and unpaid interest and special interest, if any, thereon to, but not including, the redemption date. (2) In October 2020, Viskase entered into a credit agreement providing for a $150 million term loan and a $30 million revolving c red it facility. The proceeds from the new term loan, plus cash received from the equity private placement in October 2020, were used to repay in full Viskase’s existing term loan. The new term loan an d credit facility mature in 2023. As of: As Adjusted (1) (2) ($Millions) 9/30/2020 9/30/2020 Liquid Assets: Holding Company Cash & Cash Equivalents $1,087 $1,257 Holding Company Investment in Funds 4,043 4,043 Holding Company Liquid Assets $5,130 $5,300 Subsidiaries Cash & Cash Equivalents 775 775 Total $5,905 $6,075 Subsidiary Revolver Availability: Energy $418 $418 Automotive 132 132 Food Packaging 6 36 Metals 25 25 Home Fashion 10 10 Total $591 $621 Total Liquidity: $6,496 $6,696

Deep Management Team Led by Carl Icahn • Led by Carl Icahn ‒ Substantial investing history provides IEP with unique network of relationships and access to Wall Street • Team consists of professionals with diverse backgrounds ‒ Well rounded team with professionals focusing on different areas such as equity, distressed debt and credit 25 Note: As of October 31, 2020 Name Title Years at Icahn Years of Industry Experience Keith Cozza President & Chief Executive Officer 16 19 SungHwan Cho Chief Financial Officer 14 23 Brett Icahn Portfolio Manager 16 16 Gary Hu Portfolio Manager - 10 Steven Miller Portfolio Manager - 9 Andrew Teno Portfolio Manager - 11 Jesse Lynn General Counsel 16 25 Andrew Langham General Counsel 15 21 Jonathan Frates Managing Director 5 12 6

Financial Performance 26

Consolidated Financial Snapshot 27 Net Income (Loss): Investment $118 $679 ($1,543) ($1,564) ($1,937) ($1,916) Energy 316 334 314 298 (236) (220) Automotive (51) (230) (197) (128) (149) (218) Food Packaging (6) (15) (22) (16) 3 (3) Metals (44) 5 (22) (13) (10) (19) Real Estate 549 112 16 9 (4) 3 Home Fashion (20) (11) (17) (13) (2) (6) Mining 10 1 311 311 - - Railcar 1,171 1 - - - - Holding Company 355 (639) (599) (494) (507) (612) Discontinued operations 234 1,764 (32) (24) - (8) Net income (loss) $2,632 $2,001 ($1,791) ($1,634) ($2,842) ($2,999) Less: net income (loss) attributable to non-controlling interests 178 519 (693) (693) (1,043) (1,043) Net income (loss) attributable to Icahn Enterprises $2,454 $1,482 ($1,098) ($941) ($1,799) ($1,956) Adjusted EBITDA: Investment $284 $725 ($1,437) ($1,498) ($1,792) ($1,731) Energy 405 821 880 738 32 174 Automotive 3 (48) (80) (49) (42) (73) Food Packaging 62 54 47 39 45 53 Metals 20 24 2 4 6 4 Real Estate 40 48 24 18 20 26 Home Fashion (9) - (6) (5) 5 4 Mining 22 20 70 70 - - Railcar 136 (2) - - - - Holding Company 36 (323) (343) (351) (254) (246) Consolidated Adjusted EBITDA $999 $1,319 ($843) ($1,034) ($1,980) ($1,789) Less: Adjusted EBITDA attributable to non-controlling interests 358 762 (381) (461) (822) (742) Adjusted EBITDA attributable to Icahn Enterprises $641 $557 ($462) ($573) ($1,158) ($1,047) Capital Expenditures $316 $272 $250 $195 $155 $210 ($Millions) 20192017 2018 FYE December 31, LTM September 30, 2019 20202020 Nine Months Ended September 30,

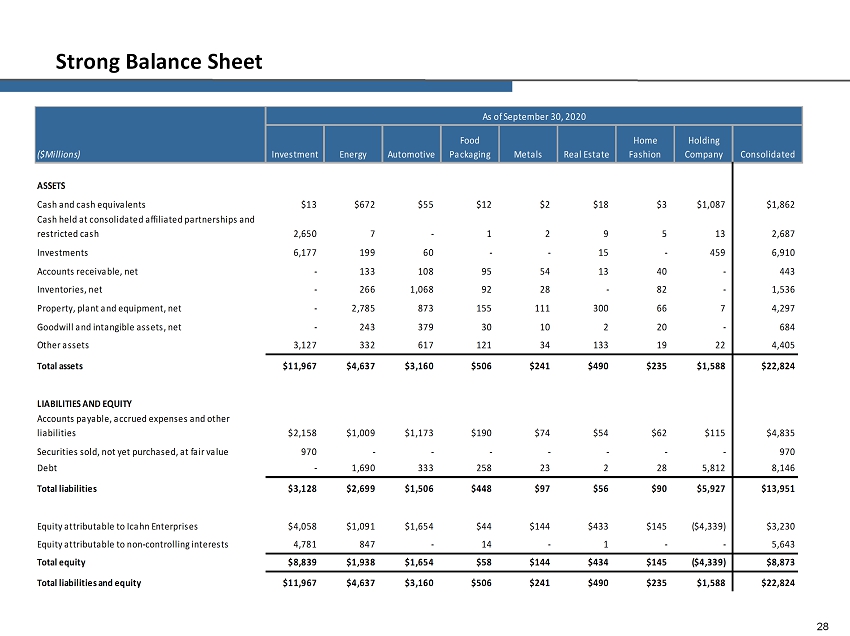

Strong Balance Sheet 28 ASSETS Cash and cash equivalents $13 $672 $55 $12 $2 $18 $3 $1,087 $1,862 Cash held at consolidated affiliated partnerships and restricted cash 2,650 7 - 1 2 9 5 13 2,687 Investments 6,177 199 60 - - 15 - 459 6,910 Accounts receivable, net - 133 108 95 54 13 40 - 443 Inventories, net - 266 1,068 92 28 - 82 - 1,536 Property, plant and equipment, net - 2,785 873 155 111 300 66 7 4,297 Goodwill and intangible assets, net - 243 379 30 10 2 20 - 684 Other assets 3,127 332 617 121 34 133 19 22 4,405 Total assets $11,967 $4,637 $3,160 $506 $241 $490 $235 $1,588 $22,824 LIABILITIES AND EQUITY Accounts payable, accrued expenses and other liabilities $2,158 $1,009 $1,173 $190 $74 $54 $62 $115 $4,835 Securities sold, not yet purchased, at fair value 970 - - - - - - - 970 Debt - 1,690 333 258 23 2 28 5,812 8,146 Total liabilities $3,128 $2,699 $1,506 $448 $97 $56 $90 $5,927 $13,951 Equity attributable to Icahn Enterprises $4,058 $1,091 $1,654 $44 $144 $433 $145 ($4,339) $3,230 Equity attributable to non-controlling interests 4,781 847 - 14 - 1 - - 5,643 Total equity $8,839 $1,938 $1,654 $58 $144 $434 $145 ($4,339) $8,873 Total liabilities and equity $11,967 $4,637 $3,160 $506 $241 $490 $235 $1,588 $22,824 Investment Energy Automotive Food Packaging Metals Real Estate Home Fashion Holding Company Consolidated ($Millions) As of September 30, 2020

Appendix 29

• IEP began as American Real Estate Partners, which was founded in 1987, and now has diversified its portfolio to seven operating segments and approximately $2 3 billion of assets as of September 30, 2020 • IEP has demonstrated a history of successfully acquiring undervalued assets and improving and enhancing their operations and fin ancial results • IEP’s record is based on a long - term horizon that can enhance business value for continued operations and/or facilitate a profit able exit strategy ‒ In 2017, IEP sold ARL for $3.4 billion, resulting in a pre - tax gain of $1.7 billion ‒ In 2018, IEP sold Federal - Mogul for $5.1 billion, resulting in a pre - tax gain of $251 million, Tropicana for $1.5 billion, resul ting in a pre - tax gain of $779 million, and ARI for $1.75 billion, resulting in a pre - tax gain of $400 million ‒ In 2019, IEP sold Ferrous Resources for aggregate consideration of approximately $550 million (including repaid indebtedness) , r esulting in a pre - tax gain of $252 million • Acquired partnership interest in Icahn Capital Management L.P. in 2007 ‒ IEP and certain of Mr. Icahn ’ s family members and affiliates are the sole investors in the Investment Funds • IEP also has grown the business through organic investment and through a series of bolt - on acquisitions Evolution of Icahn Enterprises Timeline of Recent Acquisitions and Exits (1) Based on the closing stock price of $49.32 and approximately 236.8 million depositary and general partner equivalent units outstanding a s of September 30, 2020 . As of December 31, 200 9 ▪ Mkt. Cap: $ 2 .9bn ▪ Total Assets: $1 7 . 9 bn Current (1) ▪ Mkt. Cap: $1 1 . 7b n ▪ Total Assets: $2 2 . 8 bn American Railcar Industries 1/15/10: 54.4% of ARI’s shares outstanding were contributed by Carl Icahn in exchange for IEP depositary units Tropicana Entertainment 11/15/10: Received an equity interest as a result of a Ch.11 restructuring and subsequently acquired a majority stake CVR Energy 5/4/12: Acquired a majority interest in CVR via a tender offer to purchase all outstanding shares of CVR Viskase 1/15/10: 71.4% of Viskase’s shares outstanding were contributed by Carl Icahn in exchange for IEP depositary units Year: 30 CVR Refining & CVR Partners 2013: CVR Refining completed IPO and secondary offering. CVR Partners completed a secondary offering American Railcar Leasing 10/2/13: Acquired 75% of ARL from companies wholly owned by Carl Icahn IEH Auto Parts Holding 6/1/15: Acquired substantially all of the auto part assets in the U.S. of Uni - Select Inc. Ferrous Resources 6/8/15: IEP acquired a controlling interest in Ferrous Resources Pep Boys 2/4/16: IEP acquired Pep Boys American Railcar Leasing 2017: Sale of ARL for $3.4 billion Federal - Mogul & Tropicana 10/1/18: Sold Federal - Mogul for $5.1 billion and Tropicana for $1.5 billion American Railcar Industries 12/5/18: Sold American Railcar Industries for $1.75 billion 20 10 201 1 201 2 201 3 201 4 201 5 201 6 201 7 201 8 201 9 20 20 Ferrous Resources 8/1/19: Sold Ferrous Resources for $550 million, IEP share of cash proceeds was $4 63 million

Adjusted EBITDA Reconciliation 31

Non - GAAP Financial Measures 32 The Company uses certain non - GAAP financial measures in evaluating its performance . These include non - GAAP EBITDA and Adjusted EBITDA . EBITDA represents earnings from continuing operations before interest expense, income tax (benefit) expense and depreciation and amortization . We define Adjusted EBITDA as EBITDA excluding certain effects of impairment, restructuring costs, certain pension plan expenses, gains/losses on disposition of assets, gains/losses on extinguishment of debt, major scheduled turnaround expenses, certain tax settlements and certain other non - operational charges . We present EBITDA and Adjusted EBITDA on a consolidated basis and attributable to Icahn Enterprises net of the effects of non - controlling interests . We conduct substantially all of our operations through subsidiaries . The operating results of our subsidiaries may not be sufficient to make distributions to us . In addition, our subsidiaries are not obligated to make funds available to us for payment of our indebtedness, payment of distributions on our depositary units or otherwise, and distributions and intercompany transfers from our subsidiaries to us may be restricted by applicable law or covenants contained in debt agreements and other agreements to which these subsidiaries currently may be subject or into which they may enter into in the future . The terms of any borrowings of our subsidiaries or other entities in which we own equity may restrict dividends, distributions or loans to us . We believe that providing EBITDA and Adjusted EBITDA to investors has economic substance as these measures provide important supplemental information of our performance to investors and permits investors and management to evaluate the core operating performance of our business without regard to interest, taxes and depreciation and amortization and certain effects of impairment, restructuring costs, certain pension plan expenses, gains/losses on disposition of assets, gains/losses on extinguishment of debt, major scheduled turnaround expenses, certain tax settlements and certain other non - operational charges . Additionally, we believe this information is frequently used by securities analysts, investors and other interested parties in the evaluation of companies that have issued debt . Management uses, and believes that investors benefit from referring to these non - GAAP financial measures in assessing our operating results, as well as in planning, forecasting and analyzing future periods . Adjusting earnings for these charges allows investors to evaluate our performance from period to period, as well as our peers, without the effects of certain items that may vary depending on accounting methods and the book value of assets . Additionally, EBITDA and Adjusted EBITDA present meaningful measures of performance exclusive of our capital structure and the method by which assets were acquired and financed . EBITDA and Adjusted EBITDA have limitations as analytical tools, and you should not consider them in isolation, or as substitutes for analysis of our results as reported under generally accepted accounting principles in the United States, or U . S . GAAP . For example, EBITDA and Adjusted EBITDA : • do not reflect our cash expenditures, or future requirements for capital expenditures, or contractual commitments ; • do not reflect changes in, or cash requirements for, our working capital needs ; and • do not reflect the significant interest expense, or the cash requirements necessary to service interest or principal payments on our debt . Although depreciation and amortization are non - cash charges, the assets being depreciated or amortized often will have to be replaced in the future, and EBITDA and Adjusted EBITDA do not reflect any cash requirements for such replacements . Other companies in the industries in which we operate may calculate EBITDA and Adjusted EBITDA differently than we do, limiting their usefulness as comparative measures . In addition, EBITDA and Adjusted EBITDA do not reflect the impact of earnings or charges resulting from matters we consider not to be indicative of our ongoing operations . EBITDA and Adjusted EBITDA are not measurements of our financial performance under U . S . GAAP and should not be considered as alternatives to net income or any other performance measures derived in accordance with U . S . GAAP or as alternatives to cash flow from operating activities as a measure of our liquidity . Given these limitations, we rely primarily on our U . S . GAAP results and use EBITDA and Adjusted EBITDA only as a supplemental measure of our financial performance .

Adjusted EBITDA Reconciliation by Segment – Last Twelve Months Ended September 30, 2020 33 Net income (loss) ($1,916) ($220) ($218) ($3) ($19) $3 ($6) $0 $0 ($612) ($2,991) Interest expense, net 185 114 14 15 1 - 1 - - 321 651 Income tax expense (benefit) - (71) (58) 7 - (5) - - - 41 (86) Depreciation, depletion and amortization - 343 97 26 18 17 8 - - - 509 ($1,731) $166 ($165) $45 $0 $15 $3 $0 $0 ($250) ($1,917) Impairment of assets - - - - 2 2 3 - - - 7 Restructuring costs - - 11 (1) - - 1 - - - 11 Non-service cost of U.S. based pension - - - - - - - - - - - (Gain) loss on disposition of assets, net - - 3 - (1) (7) - - - - (5) Other - 8 78 9 3 16 (3) - - 4 115 ($1,731) $174 ($73) $53 $4 $26 $4 $0 $0 ($246) ($1,789) Net income (loss) ($980) ($115) ($218) ($1) ($19) $3 ($6) $0 $0 ($612) ($1,948) Interest expense, net 88 52 14 12 1 - 1 - - 321 489 Income tax expense (benefit) - (45) (58) 6 - (5) - - - 41 (61) Depreciation, depletion and amortization - 189 97 20 18 17 8 - - - 349 ($892) $81 ($165) $37 $0 $15 $3 $0 $0 ($250) ($1,171) Impairment of assets - - - - 2 2 3 - - - 7 Restructuring costs - - 11 (1) - - 1 - - - 11 Non-service cost of U.S. based pension - - - - - - - - - - - (Gain) loss on disposition of assets, net - - 3 - (1) (7) - - - - (5) Other - 6 78 7 3 16 (3) - - 4 111 ($892) $87 ($73) $43 $4 $26 $4 $0 $0 ($246) ($1,047) Adjusted EBITDA attributable to IEP Adjusted EBITDA EBITDA before non-controlling interests Adj. EBITDA before non-controlling interests Adjusted EBITDA attributable to IEP EBITDA attributable to IEP ($Millions) Investment Energy Automotive Food Packaging Metals Real Estate Home Fashion Mining Railcar Holding Company Consolidated

Adjusted EBITDA Reconciliation by Segment – Nine Months Ended September 30, 2020 34 Net income (loss) ($1,937) ($236) ($149) $3 ($10) ($4) ($2) $0 $0 ($507) ($2,842) Interest expense, net 145 89 9 10 1 1 - - 246 501 Income tax expense (benefit) (85) (39) 3 - - 3 (118) Depreciation, depletion and amortization 256 72 19 13 13 6 - - 379 ($1,792) $24 ($107) $35 $4 $9 $5 $0 $0 ($258) ($2,080) Impairment of assets - - - - 1 2 3 - - - 6 Restructuring costs - - 8 - - - - - - - 8 Non-service cost of U.S. based pension - - - - - - - - - - - (Gain) loss on disposition of assets, net - - 1 - (1) (7) - - - (7) Other - 8 56 10 2 16 (3) - - 4 93 ($1,792) $32 ($42) $45 $6 $20 $5 $0 $0 ($254) ($1,980) Net income (loss) ($990) ($140) ($149) $3 ($10) ($4) ($2) $0 $0 ($507) ($1,799) Interest expense, net 69 41 9 8 1 1 - - 246 375 Income tax expense (benefit) (56) (39) 3 - - - - 3 (89) Depreciation, depletion and amortization 141 72 15 13 13 6 - - - 260 ($921) ($14) ($107) $29 $4 $9 $5 $0 $0 ($258) ($1,253) Impairment of assets - - - - 1 2 3 - - - 6 Restructuring costs - - 8 - - - - - - - 8 Non-service cost of U.S. based pension - - - - - - - - - - - (Gain) loss on disposition of assets, net - - 1 - (1) (7) - - - - (7) Other - 6 56 7 2 16 (3) - - 4 88 ($921) ($8) ($42) $36 $6 $20 $5 $0 $0 ($254) ($1,158) ($Millions) Investment Energy Automotive Food Packaging Metals Real Estate Home Fashion Mining Railcar Holding Company Consolidated Adjusted EBITDA EBITDA attributable to IEP Adjusted EBITDA attributable to IEP Adjusted EBITDA attributable to IEP EBITDA before non-controlling interests Adj. EBITDA before non-controlling interests

Adjusted EBITDA Reconciliation by Segment – Nine Months Ended September 30, 2019 35 Net income (loss) ($1,564) $298 ($128) ($16) ($13) $9 ($13) $311 $0 ($494) ($1,610) Interest expense, net 66 77 15 12 1 (1) 1 3 - 221 395 Income tax expense (benefit) - 98 (36) 2 - (1) - 1 - (76) (12) Depreciation, depletion and amortization - 265 73 19 14 13 5 - - - 389 ($1,498) $738 ($76) $17 $2 $20 ($7) $315 $0 ($349) ($838) Impairment of assets - - - 1 - - - - - - 1 Restructuring costs - - 3 9 3 - - - - - 15 Non-service cost of U.S. based pension - - - 2 - - - - - - 2 (Gain) loss on disposition of assets, net - - 2 - (1) - - (252) - - (251) Other - - 22 10 - (2) 2 7 - (2) 37 ($1,498) $738 ($49) $39 $4 $18 ($5) $70 $0 ($351) ($1,034) Net income (loss) ($785) $221 ($128) ($13) ($13) $9 ($13) $299 $0 ($494) ($917) Interest expense, net 33 34 15 9 1 (1) 1 1 - 221 314 Income tax expense (benefit) - 75 (36) 2 - (1) - 1 - (76) (35) Depreciation, depletion and amortization - 147 73 15 14 13 5 - - - 267 ($752) $477 ($76) $13 $2 $20 ($7) $301 $0 ($349) ($371) Impairment of assets - - - 1 - - - - - - 1 Restructuring costs - - 3 7 3 - - - - - 13 Non-service cost of U.S. based pension - - - 2 - - - - - - 2 (Gain) loss on disposition of assets, net - - 2 - (1) - - (252) - - (251) Other - - 22 7 - (2) 2 6 - (2) 33 ($752) $477 ($49) $30 $4 $18 ($5) $55 $0 ($351) ($573) ($Millions) Investment Energy Automotive Food Packaging Metals Real Estate Home Fashion Mining Railcar Holding Company Consolidated Adjusted EBITDA EBITDA attributable to IEP Adjusted EBITDA attributable to IEP Adjusted EBITDA attributable to IEP EBITDA before non-controlling interests Adj. EBITDA before non-controlling interests

Adjusted EBITDA Reconciliation by Segment – Year Ended December 31, 201 9 36 Net income (loss) ($1,543) $314 ($197) ($22) ($22) $16 ($17) $311 $0 ($599) ($1,759) Interest expense, net 106 102 20 17 1 (1) 1 3 - 296 545 Income tax expense (benefit) - 112 (55) 6 - (6) - 1 - (38) 20 Depreciation, depletion and amortization - 352 98 26 19 17 7 - - - 519 ($1,437) $880 ($134) $27 ($2) $26 ($9) $315 $0 ($341) ($675) Impairment of assets - - - 1 1 - - - - - 2 Restructuring costs - - 6 8 3 - 1 - - - 18 Non-service cost of U.S. based pension - - - 2 - - - - - - 2 (Gain) loss on disposition of assets, net - - 4 - (1) - - (252) - - (249) Other - - 44 9 1 (2) 2 7 - (2) 59 ($1,437) $880 ($80) $47 $2 $24 ($6) $70 $0 ($343) ($843) Net income (loss) ($775) $246 ($197) ($17) ($22) $16 ($17) $299 $0 ($599) ($1,066) Interest expense, net 52 45 20 13 1 (1) 1 1 - 296 428 Income tax expense (benefit) - 86 (55) 5 - (6) - 1 - (38) (7) Depreciation, depletion and amortization - 195 98 20 19 17 7 - - - 356 ($723) $572 ($134) $21 ($2) $26 ($9) $301 $0 ($341) ($289) Impairment of assets - - - 1 1 - - - - - 2 Restructuring costs - - 6 6 3 - 1 - - - 16 Non-service cost of U.S. based pension - - - 2 - - - - - - 2 (Gain) loss on disposition of assets, net - - 4 - (1) - - (252) - - (249) Other - - 44 7 1 (2) 2 6 - (2) 56 ($723) $572 ($80) $37 $2 $24 ($6) $55 $0 ($343) ($462) Adjusted EBITDA attributable to IEP Adjusted EBITDA EBITDA before non-controlling interests Adj. EBITDA before non-controlling interests Adjusted EBITDA attributable to IEP EBITDA attributable to IEP ($Millions) Investment Energy Automotive Food Packaging Metals Real Estate Home Fashion Mining Railcar Holding Company Consolidated

Adjusted EBITDA Reconciliation by Segment – Year Ended December 31, 201 8 37 Net income (loss) $679 $334 ($230) ($15) $5 $112 ($11) $1 $1 ($639) $237 Interest expense, net 46 102 16 15 - 1 1 2 - 328 511 Income tax expense (benefit) - 46 (52) (4) 1 5 - 2 2 (14) (14) Depreciation, depletion and amortization - 339 92 26 18 19 8 6 - - 508 $725 $821 ($174) $22 $24 $137 ($2) $11 $3 ($325) $1,242 Impairment of assets - - 90 - 1 - 1 - - - 92 Restructuring costs - - 5 9 - - 2 - - - 16 Non-service cost of U.S. based pension - - - 6 - - - - - - 6 (Gain) loss on disposition of assets, net - - 1 - - (89) - 3 (5) - (90) Other - - 30 17 (1) - (1) 6 - 2 53 $725 $821 ($48) $54 $24 $48 $0 $20 ($2) ($323) $1,319 Net income (loss) $319 $213 ($230) ($12) $5 $112 ($11) $3 $1 ($639) ($239) Interest expense, net 20 40 16 11 - 1 1 2 - 328 419 Income tax expense (benefit) - 36 (52) (3) 1 5 - 2 2 (14) (23) Depreciation, depletion and amortization - 171 92 22 18 19 8 3 - - 333 $339 $460 ($174) $18 $24 $137 ($2) $10 $3 ($325) $490 Impairment of assets - - 90 - 1 - 1 - - - 92 Restructuring costs - - 5 7 - - 2 - - - 14 Non-service cost of U.S. based pension - - - 4 - - - - - - 4 (Gain) loss on disposition of assets, net - - 1 - - (89) - 2 (5) - (91) Other - - 30 14 (1) - (1) 4 - 2 48 $339 $460 ($48) $43 $24 $48 $0 $16 ($2) ($323) $557 Adjusted EBITDA attributable to IEP Adjusted EBITDA EBITDA before non-controlling interests Adj. EBITDA before non-controlling interests Adjusted EBITDA attributable to IEP EBITDA attributable to IEP ($Millions) Investment Energy Automotive Food Packaging Metals Real Estate Home Fashion Mining Railcar Holding Company Consolidated ($638) ($238) (24) (15)

Adjusted EBITDA Reconciliation by Segment – Year Ended December 31, 201 7 38 Net income (loss) $118 $316 ($51) ($6) ($44) $549 ($20) $10 $1,171 $355 $2,398 Interest expense, net 166 109 13 13 - 2 - 5 23 319 650 Income tax expense (benefit) - (341) (146) 21 43 - - 3 531 (643) (532) Depreciation, depletion and amortization - 322 111 25 20 20 8 5 7 - 518 $284 $406 ($73) $53 $19 $571 ($12) $23 $1,732 $31 $3,034 Impairment of assets - - 15 1 - 2 1 - 68 - 87 Restructuring costs - - - 2 1 - 1 - - - 4 Non-service cost of U.S. based pension - - - 4 - - - - - - 4 (Gain) loss on disposition of assets, net - - (5) - - (496) - - (1,664) (1) (2,166) Other - (1) 66 2 - (37) 1 (1) - 6 36 $284 $405 $3 $62 $20 $40 ($9) $22 $136 $36 $999 Net income (loss) $80 $253 ($51) ($5) ($44) $549 ($20) $9 $1,171 $355 $2,297 Interest expense, net 58 44 13 9 - 2 - 4 23 319 472 Income tax expense (benefit) - (238) (146) 16 43 - - 2 531 (643) (435) Depreciation, depletion and amortization - 157 111 18 20 20 8 2 7 - 343 $138 $216 ($73) $38 $19 $571 ($12) $17 $1,732 $31 $2,677 Impairment of assets - - 15 1 - 2 1 - 68 - 87 Restructuring costs - - - 1 1 - 1 - - - 3 Non-service cost of U.S. based pension - - - 3 - - - - - - 3 (Gain) loss on disposition of assets, net - - (5) - - (496) - - (1,664) (1) (2,166) Other - (1) 66 2 - (37) 1 - - 6 37 $138 $215 $3 $45 $20 $40 ($9) $17 $136 $36 $641 Adjusted EBITDA attributable to IEP Adjusted EBITDA EBITDA before non-controlling interests Adj. EBITDA before non-controlling interests Adjusted EBITDA attributable to IEP EBITDA attributable to IEP ($Millions) Investment Energy Automotive Food Packaging Metals Real Estate Home Fashion Mining Railcar Holding Company Consolidated

Financial Performance 39 Net Income (Loss) Attributable to Icahn Enterprises Adjusted EBITDA Attributable to Icahn Enterprises ($Millions) Investment $80 $319 ($775) ($980) Energy 253 213 246 (115) Automotive (51) (230) (197) (218) Food Packaging (5) (12) (17) (1) Metals (44) 5 (22) (19) Real Estate 549 112 16 3 Home Fashion (20) (11) (17) (6) Mining 9 3 299 - Railcar 1,171 1 - - Holding Company 355 (638) (599) (612) Discontinued Operations 157 1,720 (32) (8) $2,454 $1,482 ($1,098) ($1,956) 2017 2018 2019 2020 FYE December 31, LTM September 30, ($Millions) Investment $138 $339 ($723) ($892) Energy 215 460 572 87 Automotive 3 (48) (80) (73) Food Packaging 45 43 37 43 Metals 20 24 2 4 Real Estate 40 48 24 26 Home Fashion (9) - (6) 4 Mining 17 16 55 - Railcar 136 (2) - - Holding Company 36 (323) (343) (246) $641 $557 ($462) ($1,047) 2020 LTM September 30,FYE December 31, 2017 2018 2019 $2,454 $1,482 ($1,098) ($1,956) FYE 2017 FYE 2018 FYE 2019 LTM 9/30/20 $641 $557 ($462) ($1,047) FYE 2017 FYE 2018 FYE 2019 LTM 9/30/20

Exhibit 99.2

Icahn Enterprises L.P. Intends to Offer New Senior Notes

(Sunny Isles Beach, Florida, January 4, 2021) – Icahn Enterprises L.P. (NASDAQ: IEP) – Icahn Enterprises L.P. (“Icahn Enterprises”) announced today that it, together with Icahn Enterprises Finance Corp. (together with Icahn Enterprises, the “Issuers”), intends to commence an offering of Senior Notes due 2029 (the “Notes”) for issuance in a private placement not registered under the Securities Act of 1933, as amended (the “Securities Act”). The Notes will be issued under an indenture by and among the Issuers, Icahn Enterprises Holdings L.P., as guarantor (the “Guarantor”), and Wilmington Trust, National Association, as trustee, and will be guaranteed by the Guarantor. The net proceeds from the offering will be used to redeem a portion of the Issuers’ existing 6.250% Senior Notes due 2022 pursuant to the Issuers’ previously announced notice of conditional redemption. There can be no assurance that the issuance and sale of any debt securities of the Issuers will be consummated, that the conditions precedent to the redemption will be satisfied, or that the redemption will occur.

The Notes and related guarantees are being offered only (1) in the United States to persons reasonably believed to be qualified institutional buyers in reliance on Rule 144A under the Securities Act and (2) outside the United States to persons other than “U.S. persons” in compliance with Regulation S under the Securities Act. The Notes and related guarantees have not been registered under the Securities Act or the securities laws of any other jurisdiction and may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirements.

This press release is being issued pursuant to and in accordance with Rule 135c under the Securities Act. This press release shall not constitute an offer to sell or a solicitation of an offer to buy any securities of the Issuers.

About Icahn Enterprises L.P.

Icahn Enterprises L.P. (NASDAQ: IEP), a master limited partnership, is a diversified holding company engaged in seven primary business segments: Investment, Energy, Automotive, Food Packaging, Metals, Real Estate and Home Fashion.

Caution Concerning Forward-Looking Statements

This release contains certain statements that are, or may deemed to be, "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, many of which are beyond our ability to control or predict. Forward-looking statements may be identified by words such as "expects," "anticipates," "intends," "plans," "believes," "seeks," "estimates," "will" or words of similar meaning and include, but are not limited to, statements about the expected future business and financial performance of Icahn Enterprises and its subsidiaries. Actual events, results and outcomes may differ materially from our expectations due to a variety of known and unknown risks, uncertainties and other factors, including risks related to economic downturns, substantial competition and rising operating costs; risks related to the severity, magnitude and duration of the COVID-19 pandemic and its impact on the global economy, financial markets and industries in which our subsidiaries operate; risks related to our investment activities, including the nature of the investments made by the private funds in which we invest, declines in the fair value of our investments as a result of the COVID-19 pandemic, losses in the private funds and loss of key employees; risks related to our ability to continue to conduct our activities in a manner so as to not be deemed an investment company under the Investment Company Act of 1940, as amended; risks related to our energy business, including the volatility and availability of crude oil, other feed stocks and refined products, declines in global demand for crude oil, refined products and liquid transportation fuels as a result of the COVID-19 pandemic, unfavorable refining margin (crack spread), interrupted access to pipelines, significant fluctuations in nitrogen fertilizer demand in the agricultural industry and seasonality of results; risks related to our automotive activities and exposure to adverse conditions in the automotive industry, including as a result of the COVID-19 pandemic; risks related to our food packaging activities, including competition from better capitalized competitors, inability of our suppliers to timely deliver raw materials, and the failure to effectively respond to industry changes in casings technology; risks related to our scrap metals activities, including potential environmental exposure; risks related to our real estate activities, including the extent of any tenant bankruptcies and insolvencies; risks related to our home fashion operations, including changes in the availability and price of raw materials, and changes in transportation costs and delivery times; and other risks and uncertainties detailed from time to time in our filings with the Securities and Exchange Commission. Additionally, there may be other factors not presently known to us or which we currently consider to be immaterial that may cause our actual results to differ materially from the forward-looking statements. Past performance in our Investment segment is not indicative of future performance. We undertake no obligation to publicly update or review any forward-looking information, whether as a result of new information, future developments or otherwise.

Contact:

Investor Contact:

SungHwan Cho

Chief Financial Officer

(305) 422-4100